Historical Trends and Future Projections: U.S. Federal Funds Rate from 1954 to 2025

Table of Contents

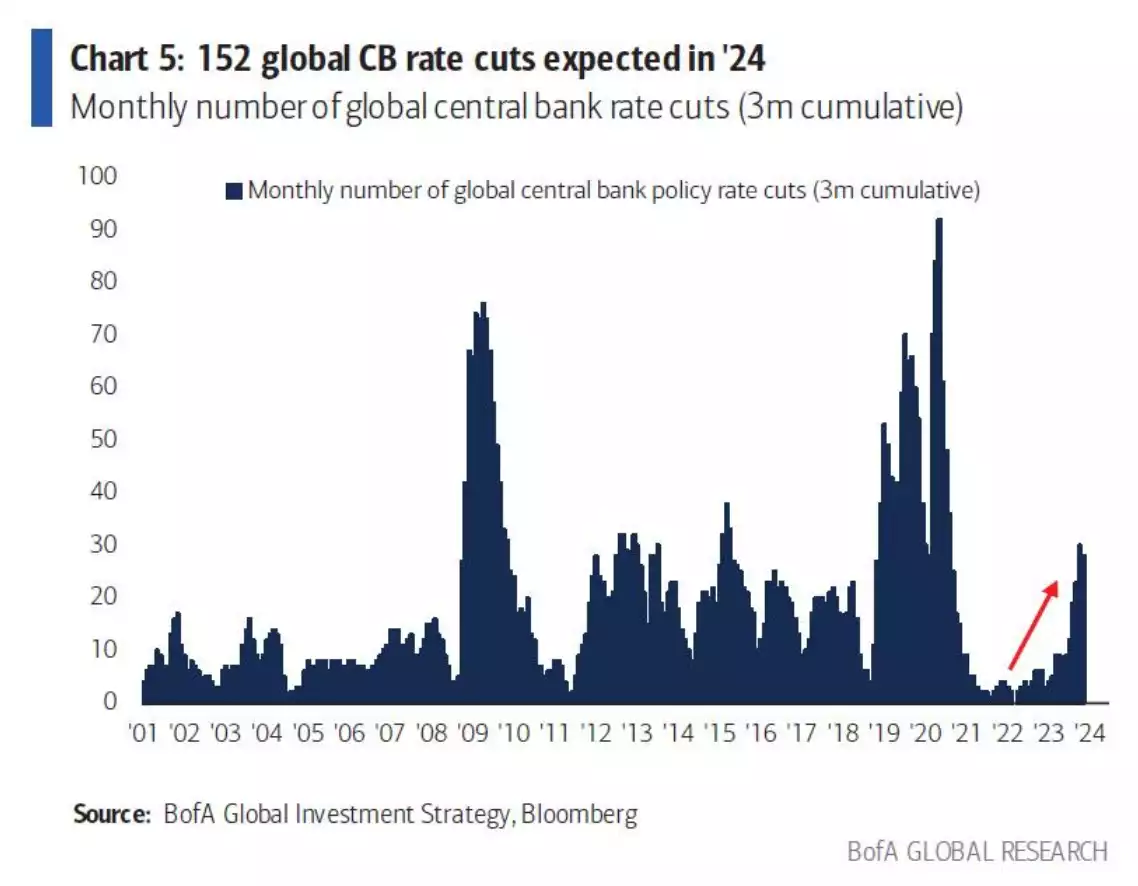

- “152 Rate Cuts in 2024” - Brace | Ainslie Bullion

- Why Would The Fed Cut Rates in 2024?

- Federal Reserve rate cut seen in Q2 of 2024 | Forexlive

- Will 2024 be the year for rate cuts?

- US Fed divided on risk of cutting rates too soon: minutes - Briefly.co.za

- When Will Interest Rates Go Down?

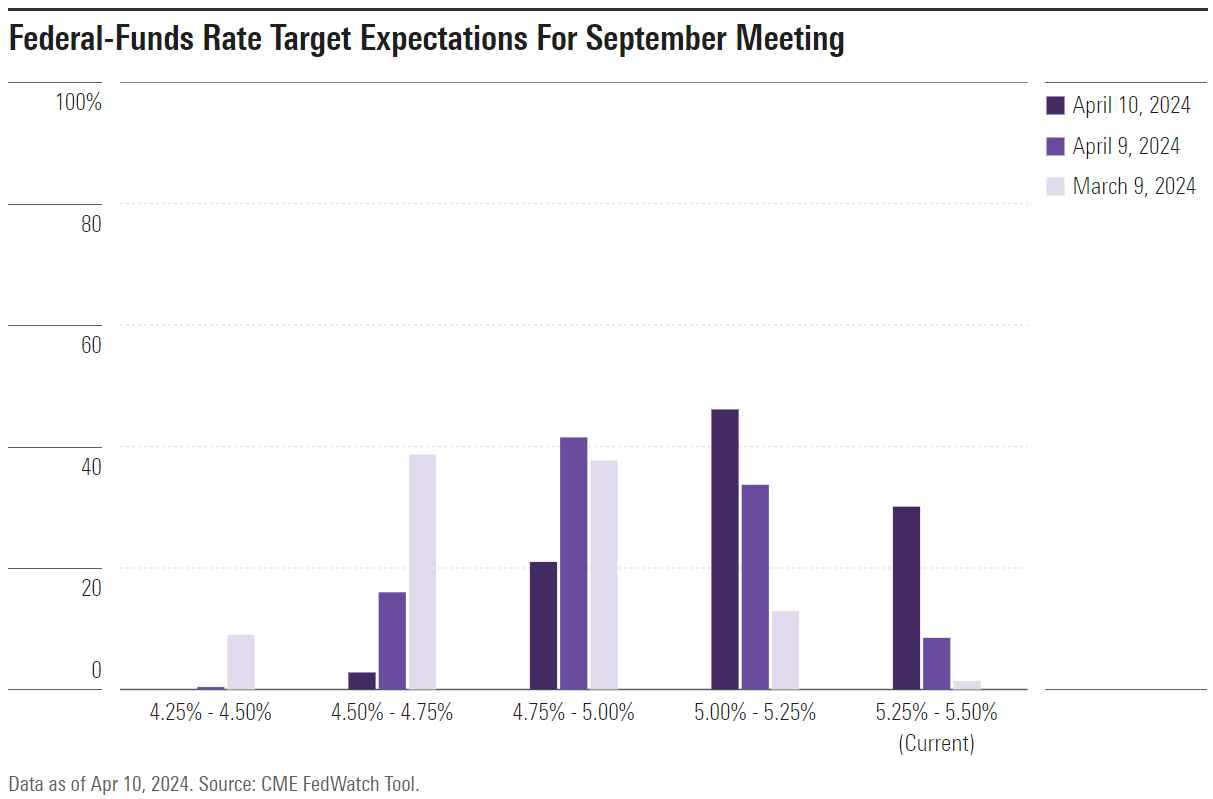

- 4 Charts on Plunging Expectations for Fed Rate Cuts | Morningstar

- “Be Fearful When Others Are Greedy” - How The Recession Will Surprise ...

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- How Many Rate Cuts In 2024 In Us - Margi Saraann

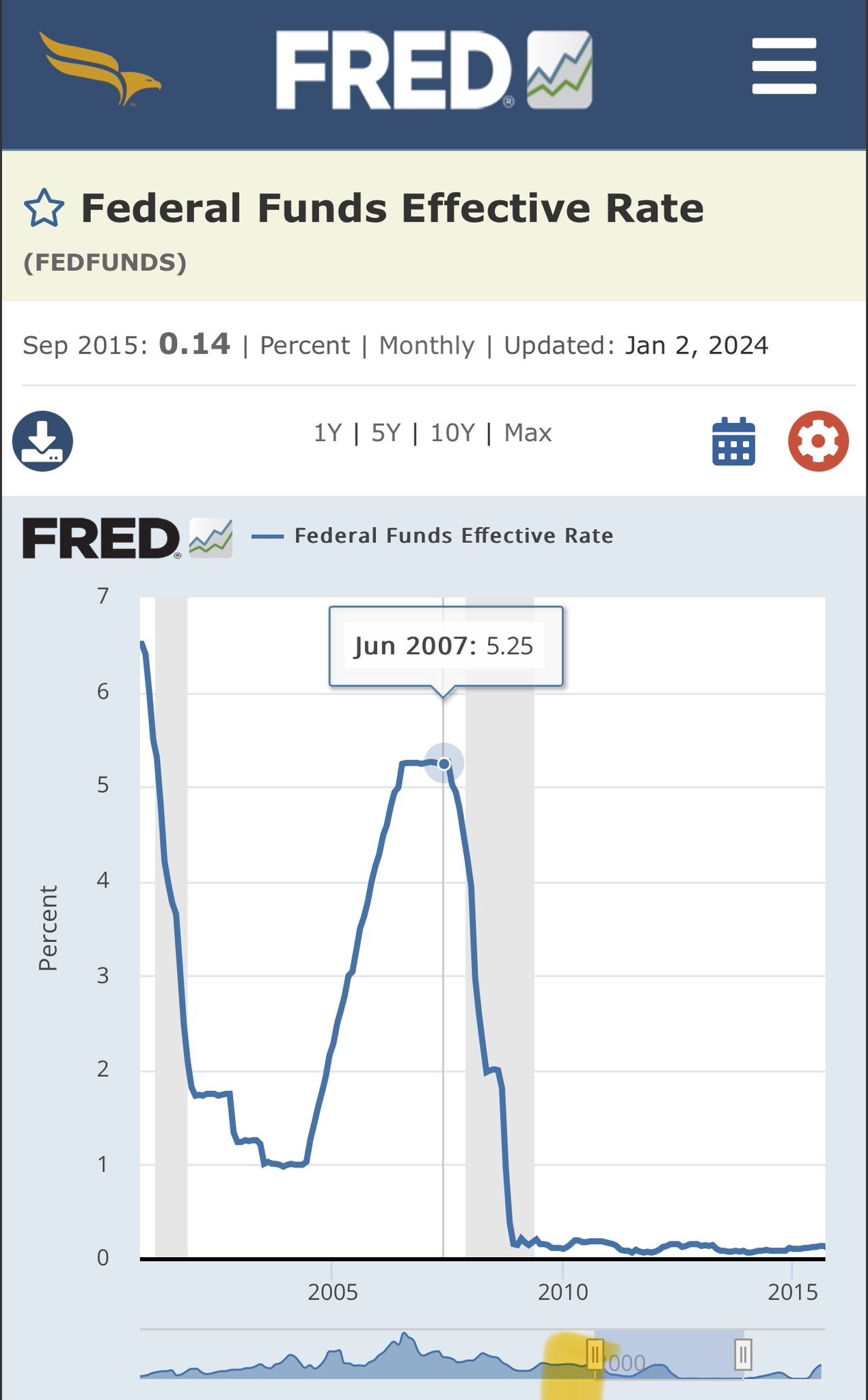

Historical Context: 1954-2020

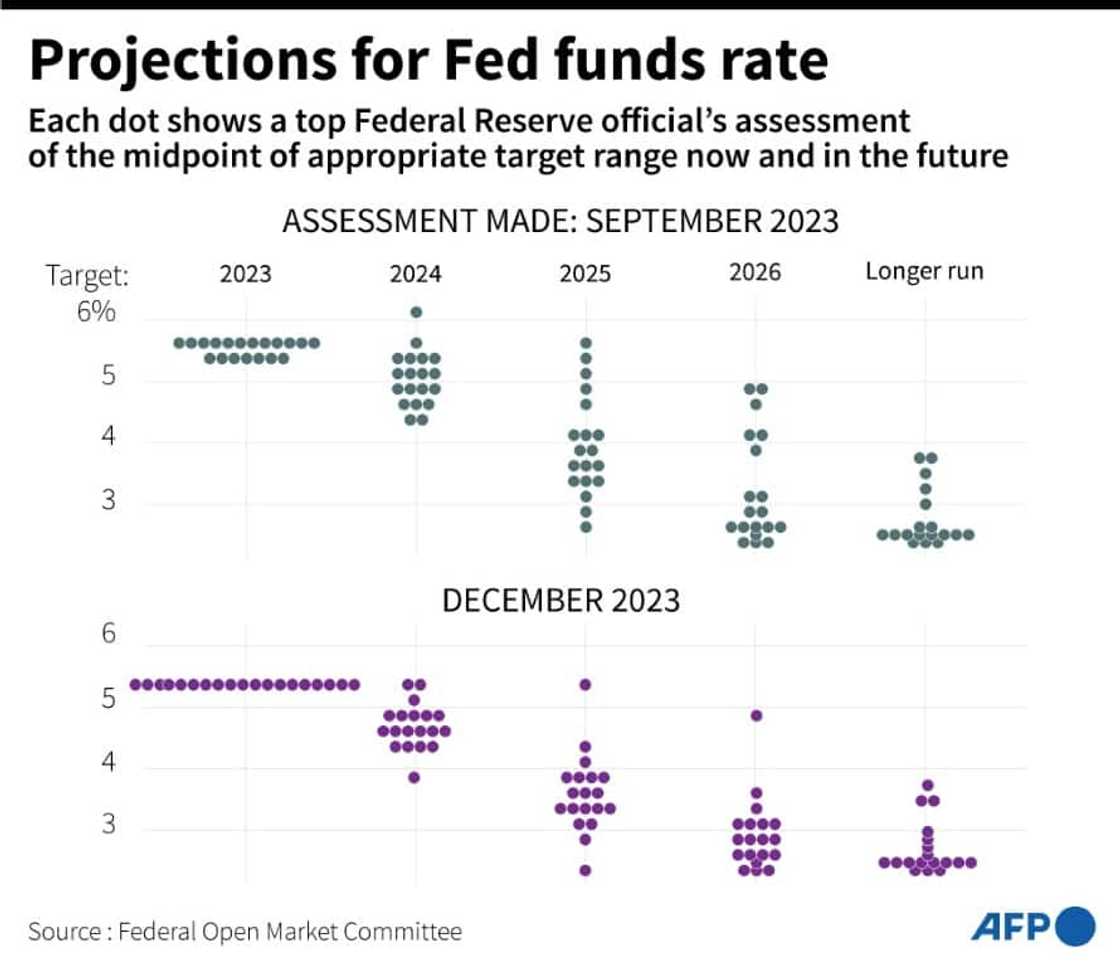

Future Projections: 2020-2025

Implications and Impact

The U.S. federal funds rate has far-reaching implications for the economy, affecting: Borrowing costs: Higher federal funds rates increase borrowing costs for consumers and businesses, which can slow down economic growth. Consumer spending: Changes in the federal funds rate influence consumer spending, as higher rates can reduce disposable income and lower rates can increase spending power. Business investment: The federal funds rate affects business investment decisions, as higher rates can make borrowing more expensive and lower rates can stimulate investment. In conclusion, the U.S. federal funds rate has experienced significant fluctuations over the past six decades, and its future projections indicate a continued upward trend. Understanding the historical context and potential implications of the federal funds rate is crucial for investors, businesses, and policymakers. As the economy continues to evolve, it is essential to monitor the federal funds rate and its impact on the economy, to make informed decisions and navigate the complexities of the financial landscape.Source: Statista - U.S. federal funds rate from 1954 to 2025

Note: The article is based on data from Statista and is subject to change based on new data releases and updates.